estate tax exemption 2022 proposal

If enacted the current 117 million per person estate and gift tax exemption would be reduced to 602 million for 2022 based on current estimates. The House estate tax proposal is to accelerate the 2026 reduction to 2022.

Essential Tax Numbers Updated For 2022 Advisor S Edge

The top rate would apply to taxable income over.

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. With no major changes now is the time to strike in Estate Planning. 5 hours agoThe proposed property tax breaks keep on coming.

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The latest one would increase exemptions for homeowners and kupuna. For example the taxpayer owns a LLC valued at 20000000 and makes a completed gift of 40 of the entity to a trust for the benefit of the taxpayers descendants in 2022 when the estate tax.

However the 117 million allowance is already scheduled to be cut in. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. This is an increase from 1170000000 for 2021.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The current federal estate tax exemption amount is 11700000 per person. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption.

Under current law this reduction was scheduled to occur after December 31 2025 but this proposal. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. Here is what you need to know.

Grantor trusts retain the same benefits and the Generation Skip Tax is equivalent to the estate tax exemption levels. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in. Proposed Estate Tax Exemption Changes.

As of January 1 2022 that will be cut in half. The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. The federal estate tax exemption for 2022 is 1206 million.

Sunday May 29 2022. However the change to the top capital gains rate which is increased to 25 is effective beginning after September. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The Time To Gift Is Now Potential Tax Law Changes For 2021. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans. The council June 2 passed a 7859 million budget which was 1758 million or 288 higher than the current year.

Under current law the existing 10 million exemption would revert back to the 5 million exemption. 2022 if the proposed law is enacted or before. Estate tax exemption 2022 proposal.

The estate tax exemption is adjusted for inflation every year. Some taxpayers made transfers usually to. Increase the top rate to 396 beginning in 2023.

Under current law the exemption is 750000 in fair market value for farmland but the exemption also is indexed for inflation which bumps the current exemption up closer to 119 million. The effective date of these tax rates and the tax bracket is January 1 2022. From Fisher Investments 40 years managing money and helping thousands of families.

The generation-skipping transfer tax GST tax exemption amount will also decrease from 117 Million per person to 5 Million per person. The size of the estate tax exemption meant that a mere 01 of. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E.

This all-time high exemption limit is unlikely to last. Increase the top rate to 396 beginning in 2023. Estate Tax Proposal 1 Reduction of the Lifetime Estate and Gift Tax Exemption.

The exemption will increase with inflation to approximately 12060000 per person in 2022. In 2026 the exemption is predicted drop to about 6600000 per person. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025.

If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate. No increase in the estate gift tax rate has been proposed nor has a reduction in the current 117 million allowance been proposed. The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012.

Tax reform proposals in 2021 aimed to reduce the exemption to approximately 6 million as early as the start. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to.

As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately 6020000 per person or 12040000 for a married couple. With inflation this may land somewhere around 6 million. HARTFORD CT Governor Ned Lamont today unveiled his first package of legislative proposals for the 2022 regular session which includes a series of tax cuts that will provide approximately 336 million in relief for Connecticut residents.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. A provision of the proposed legislation that would become effective Jan.

Lower Estate Tax Exemption. The governor said that he is proposing the tax cut package as the state is projecting an. 2022 Estate Gift Tax Exemption Exclusion.

Heres a look at how this exemption has changed over the years. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State. The proposed 995 Act never materialized.

The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million today. For people who pass away in 2022 the Federal exemption amount will be 1206000000. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for inflation.

Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to approximately 62 million by 2026.

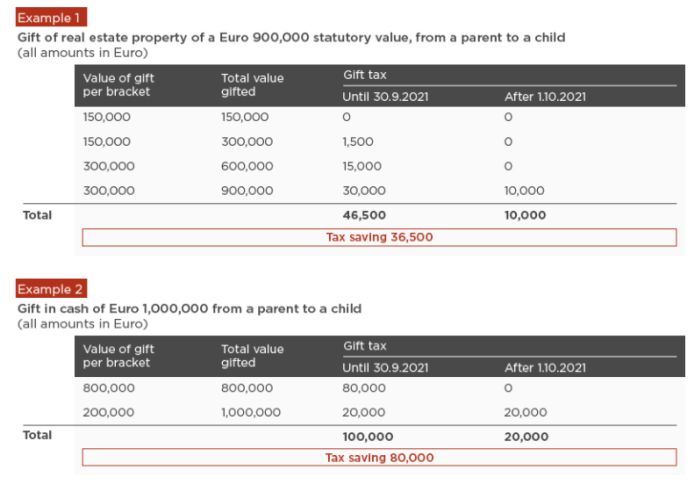

Greece Increases Gift Tax Exempt Bracket From October 1 2021 Inheritance Tax Greece

U S Estate Tax For Canadians Manulife Investment Management

U S Estate Tax For Canadians Manulife Investment Management

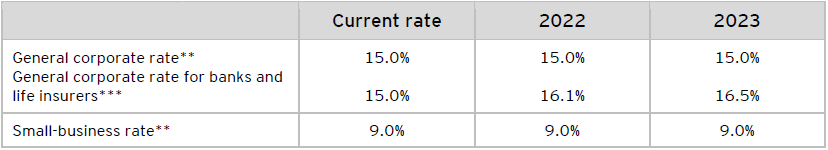

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

What Is Estate Tax And Inheritance Tax In Canada

Update Surplus Stripping And The New Costly Tax Loophole For Intergenerational Transfers Fon Commentaries Vol 2 No 3 Finances Of The Nation

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates

Inheriting A Secondary Residence Some Planning May Be Required Sfl Wealth Management Sfl Investments

Tax Brackets Canada 2022 Filing Taxes

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

How Tax Rates In Canada Changed In 2022 Loans Canada

What Happened To The Expected Year End Estate Tax Changes

U S Estate Tax For Canadians Manulife Investment Management

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Biden Greenbook Estate Tax Proposals Should You Care

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates